Understanding

Your Mineral Appraisals

Frequently Asked Questions

-

My well is appraised for more money than I made last year. Why is that?

Mineral interest in Texas, as per the Texas Tax Code, are appraised as a Property Tax, not as an income tax.

The appraised value is the market value of the mineral interest if you were going to sell your interest in the producing well.

-

How are the values arrived at?

Minerals are classified as real property in Texas.

Each property (lease) is appraised separately and the value is allocated to each owner

based on your decimal interest ownership in the lease. The appraised value representsthe fair market value of the property (the

lease/wells) as of January 1 of each year. The fair market value generally represents a reasonable value for which you might consider

selling your interest.

The appraised value is calculated by projecting the future income of the property.

Your previous year’s income is not a legal basis for the appraisal.

The projected future income calculation is called a discounted cash flow analysis and uses the following information:

1) INITIAL PRODUCTION RATE:

Normally the actual January 2023 monthly production (Barrels or MCF per month). Monthly production information is

publicly available from the Texas Railroad Commission online production records.

2) RATE OF DECLINE:

A decimal number representing the initial annual % rate the production is projected to fall off. This ‘decline rate’ is

established from the prior historical trend of the lease or from similar leases.

3) PRICE OF OIL AND GAS

The actual 2022 oil or gas production price received from each lease is multiplied by a ‘Price Adjustment Factor’

(Oil=84%, Gas=76%) and the resulting value is used as the price for the first appraisal year. The prices used in the second

through sixth year (2-6), escalate the first-year price by 2.4% per year for oil and by 2.3% per year for gas. Prices are held

flat after the sixth year. The average 2022 oil and gas production prices are obtained from Texas Comptroller severance

tax records, Operator data, royalty owner information and Railroad Commission production data.

4) LEASE OPERATING EXPENSES (LOE)

Average monthly lease operating costs from the preceding year as submitted directly by the operator are used if available.

Otherwise, reasonable operating costs for the area are used and calculated as a function of depth and number of wells.

5) PRODUCTIVE LIFE OF THE WELL

Monthly income is calculated until the revenue received by the working interest is less than the monthly lease operating

expense. We assume an operator won’t continue to produce the lease once they begin to lose money.

6) SEVERANCE TAX EXPENSE

Severance taxes are deducted from the monthly lease income. The normal rates are: Oil=4.6%, Gas=7.5%.

7) EQUIPMENT VALUE

The salvage value of lease equipment (personal property) is added to the working interest (only) as a capital asset. The

value is calculated as a function of the depth and number of wells on the lease.

8) DISCOUNT RATE

Income you receive at some time in the future is not as valuable as income you could receive today. Discount rate factors

have been determined and used to calculate a reduced present value of the future income calculated in the appraisal.

Using all the gathered appraisal information on the lease including the factors identified above, the future income from the lease is

calculated over its economic life and then discounted to determine the appraised value. The calculations follow the basic steps

described below:

- Projected future gas, condensate and oil production rates are calculated using standard petroleum engineering methodology, based primarily on projection of historical production performance.

- Future monthly revenues are calculated by multiplying projected production volumes by the oil and gas prices, deducting the severance taxes, and then separating out the working interest (87.5%) and royalty interest (12.5%) portions of the revenue.

- The monthly working interest net revenue (cash flow) is calculated by subtracting the monthly operating expenses from the projected monthly revenue. When the monthly working interest net revenue is less than the monthly operating expense the projection stops. Monthly operating expenses are not deducted from the royalty interest monthly income.

- The future monthly income is discounted to establish its 1/1/2023 value. The sum of the discounted future revenues from each month of the well’s projected life is the January 1, 2023 fair market appraised value of the well.

-

How do I protest my value?

A protest form is included in the notice of appraised value you receive. Fill out and mail the protest form to the Appraisal District.

-

How can the value go up if the wells are depleting?

The value of the well is based off of the economic situation on January 1st of the tax year. As the economic situation changes every year, the value of the well can change for a variety of reasons.

- The price is a significant indicator of the value of the well, so if the gas prices are higher, the value of the well can also be higher.

- Over time, the well might start declining at a slower rate than in the past, which could mean the economic forcast of the well is better than what was appraised the prior year.

- The operator could have made changes to the well which cause it to be producing at a more efficient rate than in prior years.

-

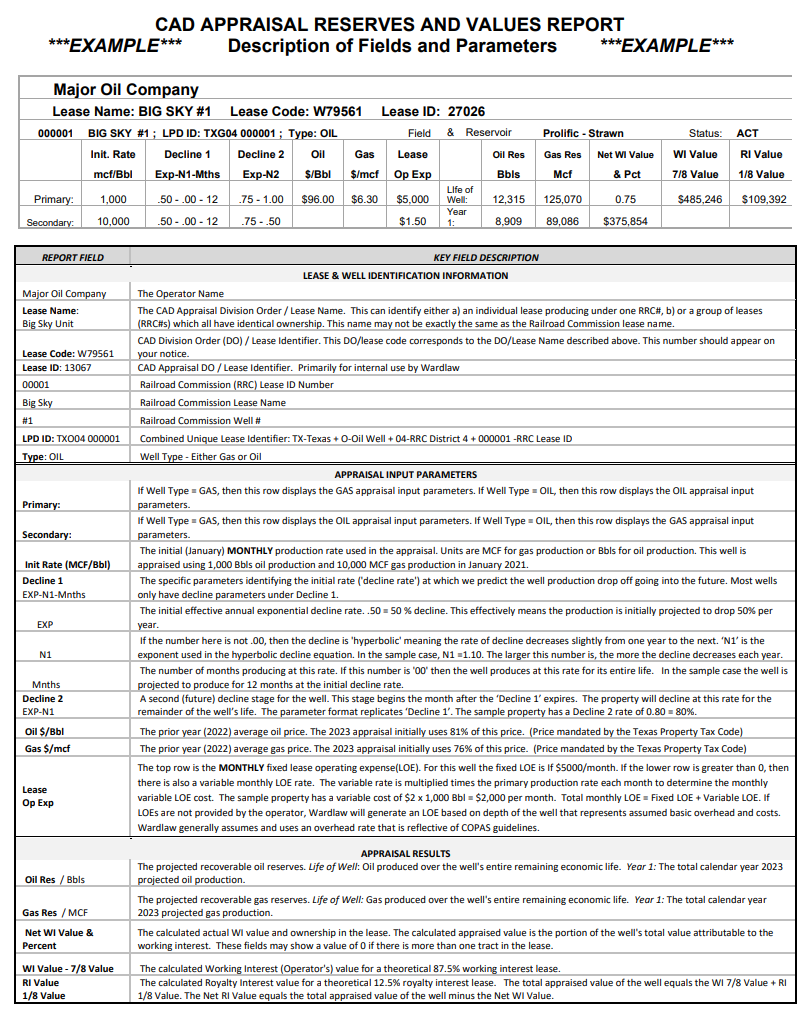

I have the Reserves and Values form, what does it mean?

Look at the attached image explaining the fields of the reserves and values form.